ICICI Bank login, as this includes sensitive information that could be misused. Sharing account details or login credentials is a security risk and I would never do anything that could put your financial information at risk.

However, I can offer you some general information about ICICI Bank login and provide you with some helpful blog headlines that you can use

Table of Contents

Navigating ICICI Bank Online: Your Access Guide

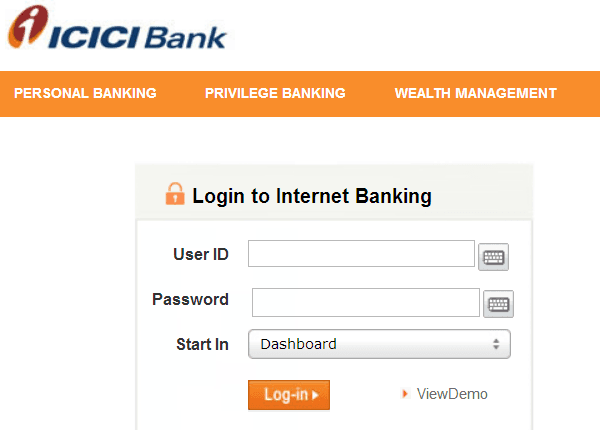

Discover the ease of managing your finances through ICICI Bank’s internet banking and mobile banking services. Here’s a simple guide to smoothly navigate the login process:

1. Access Points: ICICI Bank offers two primary access points for your convenience:

2. Internet Banking: Log in using your Customer ID and Password.

An online reset option is available if you forget your password.

3. Mobile Banking: Access your account using your Mobile Banking PIN.

Login Credentials:

To embark on your journey into the world of ICICI online banking, ensure you have your Customer ID and Password on hand. These act as your keys, unlocking a range of financial services at your fingertips.

4. Forgotten Password or PIN? No Worries: If your memory fails you, there’s no need to panic. ICICI Bank provides user-friendly solutions:

For a forgotten password, use the online reset option.

If you can’t recall your Mobile Banking PIN, consider calling the customer service helpline for prompt assistance.

5. Your Financial Hub Awaits: Once logged in, access a plethora of services, from fund transfers to bill payments, all from the comfort of your home. ICICI Bank’s online platform is designed with your convenience in mind.

6. Security First: Rest easy knowing that your financial data is secure. ICICI Bank employs robust security measures to safeguard your online transactions and sensitive information.

7. Seamless Banking Anytime, Anywhere: Whether you’re at home or on the go, ICICI Bank’s internet and mobile banking services ensure that managing your finances is a breeze.

Embark on a digital banking experience with ICICI Bank – where simplicity meets security, and your financial control is just a login away.

ICICI Bank Login

Login-upHow to Securely Log In to Your ICICI Bank Account Online

Safeguarding Your ICICI Bank Online Login: A Human-Centric Guide

Logging into your ICICI Bank account online is more than just entering credentials—it’s about ensuring a secure gateway to your financial world. Here’s your personalized guide to a secure and human-friendly login experience:

1. Embark on the Right Path:

Begin your journey by navigating to the official ICICI Bank website. Always look for the reassuring “https://” at the beginning of the URL, ensuring a safe connection.

2. Spot the Doorway:

Locate the login section on the homepage. This is where you’ll start the process using your unique identifiers—your Customer ID and Password.

3. Connect Confidently:

Choose a secure and private network for your login endeavors. Public Wi-Fi may not be your best companion when dealing with sensitive financial matters.

4. Careful Credential Entry:

Enter your Customer ID and Password meticulously. Ensure that Caps Lock is in its rightful place and that your fingers dance accurately on the keyboard.

5. Master the Art of Passwords:

Craft a robust password as if it were your digital fortress. Combine uppercase and lowercase letters, sprinkle in some numbers and special characters. Avoid the predictable; let your password be your secret.

6. Double the Defense: Enable Two-Factor Authentication (2FA):

If ICICI Bank offers Two-Factor Authentication, embrace it. This superhero sidekick adds an extra layer of defense by requiring a code sent to your trusted mobile sidekick.

7. Guard Your Secrets:

Keep your login details classified. Your ICICI Bank login is a secret handshake between you and your finances. Don’t share it with anyone.

8. Exit with Purpose: Logout After Usage:

It’s courteous to log out, especially when you’re sharing the digital space with others. Your account deserves its privacy.

9. Password Glow-Up Routine: Regularly Change Passwords:

Change your password regularly; it’s like giving your account a new set of armor. Stay one step ahead of potential intruders.

10. Spy on Your Own Account: Monitor Account Activity:

Keep tabs on your financial haven. Regularly check your account statements to ensure all transactions align with your financial adventures.

11. Update Your Contact Watchtower:

Your mobile number and email are your lookout towers. Keep them updated, so you never miss a distress signal or a friendly reminder.

12. Dodge the Phishing Nets:

Watch out for digital phantoms. If an email or message seems fishy, it probably is. Avoid clicking on links that lead to murky waters.

By embracing these human-friendly steps, you’re not just logging in; you’re ensuring a secure and personalized financial experience. Navigate wisely, and let the digital realm of ICICI Bank be your trusted companion in your financial journey.

5 Tips for Keeping Your ICICI Bank Login Information Safe

Safeguarding Your ICICI Bank Login: 5 Human-Centric Tips

In the era of online banking, securing your financial data is paramount. Safeguard your ICICI Bank login with these five essential tips, blending simplicity with robust protection:

1. Craft a Fort Knox-worthy password: Complexity is Key: Mix uppercase, lowercase, numbers, and symbols for a password that’s hacker-resistant.

Mix it Up: Avoid predictable patterns or reused passwords across multiple accounts.

Uniqueness Matters: Each account deserves its shield; don’t compromise others if one falls.

2. Befriend two-factor authentication (2FA):

Double the Defense: Enable 2FA for an added layer of security, requiring a second code for login.

Convenience and Security: ICICI Bank offers 2FA – embrace the extra shield for peace of mind.

3. Steer Clear of Phishing Scams: Wide Net of Phishers: Be cautious of suspicious emails, texts, or fake websites aiming to trick you.

Skepticism Wins: Avoid clicking on unknown links or attachments – when in doubt, verify directly with ICICI Bank.

4. Guard Your Devices Like a Dragon: Keep Software Updated: Regularly update your operating system, browser, and antivirus software to close vulnerabilities.

Beware of Public Wi-Fi: Opt for secure networks; public Wi-Fi can be a playground for hackers.

Lock It Down: A strong device lock is your first line of defense – never leave your device unattended.

5. Stay Informed and Vigilant: Knowledge is Power: Stay updated on cybersecurity threats. ICICI Bank provides regular security tips – make them your shield.

6. Report Suspicious Activity: If something seems off, report it promptly to ICICI Bank for swift action.Implementing these human-friendly measures ensures your ICICI Bank login remains a fortress against potential threats. Embrace the simplicity and strength of these tips, allowing you to bank online with confidence. Your financial security is in your hands – wield it wisely.

What to Do If You Forget Your ICICI Bank Login Password

Regaining Access to Your ICICI Bank Account: A Human-Centric Guide

We’ve all been there—forgetting a login password can be stressful. But fear not! Here’s a user-friendly guide to swiftly and securely regain access to your ICICI Bank account:

1. Online Password Reset:

Head to the ICICI Bank website and click on “Forgot Password” in the login section.

- Input your registered mobile number or customer ID.

- Receive a One-Time Password (OTP) on your registered mobile number or email.

- Enter the OTP and follow on-screen instructions to set a new password.

2. Grid Card Authentication:

- If you have a debit card, you can use Grid Card Authentication:

- Enter your User ID and mobile number for an OTP.

- Input the OTP and the last 6 digits of your debit card.

- Use the Grid Card from your debit card to set the new password.

3. Customer Care:

- If online options are inaccessible, reach out to ICICI Bank customer care:

- Provide your customer ID and answer security questions for identity verification.

- The customer care representative will guide you through the password reset process.

4. Branch Visit:

- Visit your nearest ICICI Bank branch with a valid photo ID:

- Inform the bank staff about the forgotten password.

- After identity verification, they will assist you in resetting the password.

Important Tips:

- Never share your login credentials, not even with bank officials over the phone.

- Opt for a robust password with a mix of characters.

- Enable two-factor authentication (2FA) for an added layer of security.

- Report any suspicious activity promptly to ICICI Bank.

By following these steps, you can quickly and securely regain control of your ICICI Bank account, even if the password is forgotten. Remember, vigilance is key to safe and happy banking!

ICICI Bank Login

Login-upHow to Set Up Mobile Banking for Your ICICI Bank Account

Unlocking Convenience: A Guide to Setting Up ICICI Bank Mobile Banking

Setting up mobile banking for your ICICI Bank account is a breeze and unlocks a world of convenience at your fingertips! Here’s a guide to get you started safely and securely:

1. Download the ICICI Bank Mobile Banking App:

- Head to the app store on your smartphone (Play Store for Android, App Store for iOS) and search for “ICICI Bank Mobile Banking.”

- Make sure you download the official app from ICICI Bank to avoid phishing scams.

2. Activate Mobile Banking:

- Launch the app and choose “New User Registration” or “Activate Mobile Banking.”

- Enter your registered mobile number and customer ID.

- Receive an OTP (One-Time Password) on your registered mobile number. Enter it to verify your identity.

- Create a strong password for your mobile banking app, following best practices like avoiding personal information and using a mix of uppercase, lowercase, numbers, and special characters.

3. Set Up MPIN:

- For added security, create a 4-digit MPIN (Mobile Banking PIN) for faster and more secure logins.

- Remember, your MPIN is different from your regular ICICI Bank account password. Keep it confidential!

4. Explore the App’s Features:

- Once logged in, explore the vast features of the ICICI Bank Mobile Banking app. You can:

- Check your account balance and transaction history.

- Make transfers between your ICICI Bank accounts or to other banks.

- Pay bills, recharge your mobile phone, and top-up FASTag.

- Request a cheque book or stop a payment.

- Locate ATMs and branches.

- And much more!

Safety Tips:

- Never share your mobile banking app login details with anyone.

- Avoid downloading the app from unofficial sources.

- Update the app regularly for improved security and features.

- Be cautious when using public Wi-Fi for mobile banking.

- If you lose your phone, report it to ICICI Bank immediately to block your mobile banking access.

Enjoy the convenience and security of ICICI Bank Mobile Banking! Remember, responsible use and vigilance are key to a safe and rewarding experience.

Bonus Tip: Explore the ICICI Bank website or app for guided tutorials and FAQs on mobile banking. They offer detailed information and helpful tips to navigate the app with ease and confidence.

The Complete Guide to ICICI Bank Internet Banking

Demystifying ICICI Bank Internet Banking: Your Personal Guide

Embarking on the online banking journey might seem like a daunting task, but fear not! This all-encompassing guide is your key to mastering ICICI Bank internet banking, unlocking its full potential with confidence and ease.

Getting Started:

Access: Navigate to the ICICI Bank website (https://www.icicibank.com/) and click on “Log in to Internet Banking.”

Credentials: Enter your User ID and password. If you’re a new user, kickstart your journey through the “New User” option and follow the simple instructions.

Security: Fortify your account with Two-Factor Authentication (2FA). Opt for OTP through SMS or email, or utilize a security token for an additional layer of protection.

Exploring the Features:

Account Overview: Gain a holistic view of your finances. Monitor balances, scrutinize transactions, and track activities across savings, current, and credit card accounts.

Fund Transfers: Effortlessly move funds between your ICICI Bank accounts or to other banks. Schedule future transfers or establish standing orders for recurring payments.

Bill Payments: Settle utility bills, recharge your mobile, pay insurance premiums, and more – all directly from your internet banking platform. Save time and steer clear of late payment charges.

Investments: Take charge of your investments in mutual funds, fixed deposits, and PPF accounts. Monitor returns, make contributions, and redeem investments conveniently. Loans & Credit Cards: Access details of your loans and credit cards, monitor EMIs, make payments, and request statements. Stay informed about interest rates and conveniently manage credit card rewards. Other Services: Explore a myriad of services, including cheque book requests, stop payments, tax payments, travel bookings, and more. Uncover the platform’s full potential through exploration.

Safe & Secure Banking:

Strong Passwords: Craft a robust and unique password, incorporating uppercase and lowercase letters, numbers, and special characters. Avoid personal information and guard it against sharing.

Beware of Phishing: Exercise caution with emails, texts, or websites claiming affiliation with ICICI Bank. Verify links before clicking and abstain from entering credentials on unofficial platforms.

Regular Updates: Ensure your internet browser and operating system are up to date with the latest security patches.

Logout Always: Terminate your internet banking session after each use, especially when on public computers.

Additional Tips:

- Download the ICICI Bank Mobile Banking app for seamless access to your finances on the go.

- Set up alerts for notifications on transactions, low balances, and upcoming payments.

- Make use of the “Quick Pay” feature for instant transfers to frequently contacted individuals.

- Explore the educational resources and FAQs on the ICICI Bank website to enhance your understanding of internet banking features and best practices.

In Conclusion:

ICICI Bank internet banking provides a convenient and secure avenue for managing your finances anytime, anywhere. By adhering to the tips and resources outlined above, you can unlock its full potential, ensuring a smarter and simpler banking experience. Always stay vigilant, exercise caution, and relish the convenience of online banking with confidence